This post is loosely based on my Presentation at Polkadot Prague on the 5th of June.

What’s the first thing that comes to mind when you hear “Japan?”

Chances are it’s something like Anime, Gaming, Cars, Tokyo, Food, or convenience stores if you’ve been there and experienced true convenience.

During my talk at Polkadot Prague, people hit most of the above suggestions. Web3 isn’t one of them… yet.

However, things are looking up in the land of the rising sun for crypto startups. And Japan remains an attractive place, not least because of some of its export successes. There’s something for everyone:

- Anime: Estimates suggest that over a third of the world’s population watches anime — a considerable success, leading to the aggregation of very powerful IP.

- Cars: Toyota remains one of the biggest companies worldwide — the Japanese car industry exports roughly $80 billion of cars to other nations.

- Gaming: Japan still ranks third for digital gaming revenues, with $22.9 billion in sales and over 70 million players counting casual gamers. Beyond Japan, who hasn’t heard of Nintendo or at least played a game like Zelda, Smash, or Final Fantasy?

- Food: By now, nearly every medium size town has at least a Japanese (ish) restaurant. Netflix series like Jiro’s Dream of Sushi and Midnight Diner further expanded the Japanese attitude to food, and Nobu has become a world-recognized franchise quickly.

Fair to say, Japan has had quite some success in parts exporting to the world. However, even though you’d think with their affinity for new tech, the country would be a place to adopt crypto and web3 quickly, it hasn’t played out like that.

A few big exchange hacks are primarily to blame. An early adopter crowd of Bitcoiners in Japan gave rise to the first big crypto exchange at the time: Mt Goxx. The hack in 2014 made news worldwide and highlighted the dangers of a lack of regulation of exchanges. Consequently, regulators would require exchanges to register with authorities. Another two exchange hacks (Coincheck and Zaif) later, rules further tightened to increase oversight and allowed exchanges to only list assets that had been approved.

In addition to the unattractive taxation of virtual assets, this has led many web3 entrepreneurs to set up shop outside of Japan, with many VCs investing in crypto, keeping an entity outside to invest in tokens.

Why Japan and why now?

Fortunately, the tone is shifting. Japan’s policymakers and regulators are starting to see the potential of the technology and moving to create a better framework for it. It might help that the Japanese market didn’t get impacted by the recent FTX crash thanks to regulation, meaning people maintained a more positive attitude.

Web3 Office

In July 2022, the liberal democratic party established a Web3 office directly under the Ministry of Economy, Trade, and Industry to focus on policies and initiatives to attract investments and expand web3.

Cool Japan

On April 6th, the web3 office published a “Cool Japan” paper outlining recommendations to make Japan more attractive to web3 startups and for enterprise use. Among other things, the whitepaper suggests tax reforms easing the burden on web3 companies holding digital assets and pushing for creating accounting standards to deal with crypto assets. Additionally, the team requests that procedures to review new tokens should be made transparent so issuers are better prepared and overhead is reduced.

In a note on NFTs, the paper suggests that public and private companies should work together on guidelines based on business models similar to fantasy sports services. It also identifies areas such as rights management and licensing as areas to work on further.

Stablecoins

Japan is opening up to stablecoins with its bill announced last year after the Terra collapse. In 2022 parliament passed a framework around stablecoins which came into effect on June 1st this year, adding a safety net for investors by requiring that they are tied to the yen or other legal tenders to ensure redemptions. Furthermore, only licensed banks, registered money transfer agents, and trust companies can issue stablecoins.

With the outlook of a clear framework, one of the biggest banks in Japan, MUFG, announced the launch of their stablecoin issuance platform: Progmat coin, which banks in Japan can use to create yen-pegged stablecoins on various blockchain networks, particularly cosmos IBC, polygon, and Astar Network.

Metaverse ambitions

Last year, Toda in Saitama adopted metaverse schooling to curb absenteeism.

In February this year, renowned tech companies, including Fujitsu and Mitsubishi UFG Financial Group, took it further and agreed to form a metaverse economic zone. This zone will be called Ryogoukoku and explore interoperability between metaverse platforms, new social infrastructure for enterprises, and consumer marketing. The financial players involved will also investigate how metaverses can tie in with identity authentication and data security questions.

DAOs

Should governments be afraid of DAOs or embrace them? The Japanese digital agency chose later and started its own DAO to find out how the framework could help shape government and similar structures. Part of their working group DAO’s goal is understanding token design, governance, and even more apparent elements such as setting up wallets.

Surprisingly, they even started using Discord, which ironically remains a big tool for DAOs, despite being messy and very web2.

Culture

A less web3-related reason, however, is that Japan has a unique culture for collecting and supporting your favorite creators.

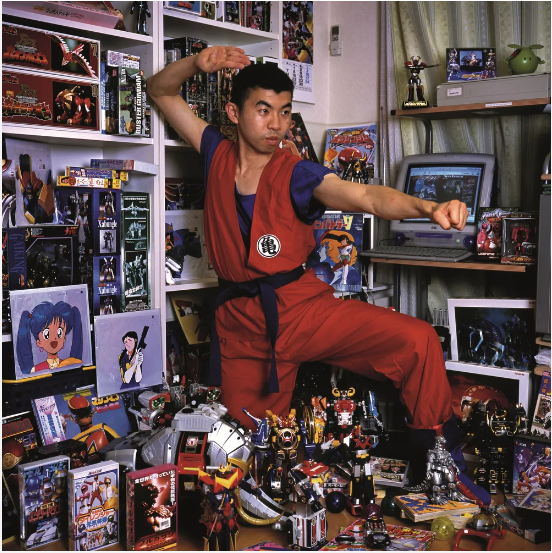

Otakus, people “obsessed” with some aspect of pop culture, such as manga or anime, are a great example. While the term used to be semi-loaded and referred to usually males over-investing in their hobby of choice, the mage of Otakus has shifted as manga and anime became more popular.

Note there are all kinds of Otakus, from video games to idol groups and trains.

Otakus will spend significant time and money securing goods displaying their favorite characters, so much so that a photographer even created a picture band of Otakus with their collections.

OTAKU SPACES © 2012 by Patrick W. Galbraith and Androniki Christodoulou.

The Gachapon machine is one of the greatest examples of real-life collectibles. These capsule toy dispensers don’t allow fans to pick, but you’ll insert coins, turn the wheel, and receive a random one. Popular among hardcore collectors and casual fans, you can find these machines literally anywhere.

The same collection culture has contributed to shaping a very different landscape of NFTs in Japan, where the focus is less on flipping and more on community and collecting.

Japan remains one of the largest markets with a high GDP/capita ratio. It’s home to brands and IPs loved worldwide. It also boasts a tight-knit community excited about web3, and recently even the regulatory framework is shaping up to welcome web3 projects and founders more readily. An attractive destination, but some challenges remain.

Japan ranks low among developed nations in its English proficiency. According to a 2022 survey by Education First, it ranks 80 out of 112 countries. That means proper localization is often key to success.

Bureaucracy can pose another hurdle, as well as getting used to the business culture. The Japanese market is dominated by conglomerates, where often, your best way to connect is to know someone already. Building relationships takes time and diplomacy.

And yet, Japan is definitely a market worth exploring. As Astars’ success at home shows, enterprises are interested in innovating and building in web3.

Stay tuned to learn more about the Japanese web3 scene. We’ll continue sharing more content around that in the future.

And don’t hesitate to reach out if you have specific questions. Our team is happy to help and explore if there are opportunities to grow in Japan together!

—

By Naomi, Marketing @AstarNetwork