Table of Contents

TL;DR

Astar is shifting its focus from external ecosystem utility to building products under Astar Collective control that generate sustainable value for ASTR.

Two parallel initiatives define this direction:

- Astar Stack, led by the Astar Foundation, delivering products aligned with ASTR and revenue generation

- Burndrop, developed with Startale Group, progressing as external conditions allow

At the same time, Astar will continue to collaborate with key partners, including Startale Group and Soneium.

Together, they define the Astar Collective’s execution focus for 2026 and its path toward long-term ASTR value.

From Foundations to ASTR Value Creation

In 2025, it became clear that ecosystem expansion alone is not enough without strong product usage at the core of Astar.

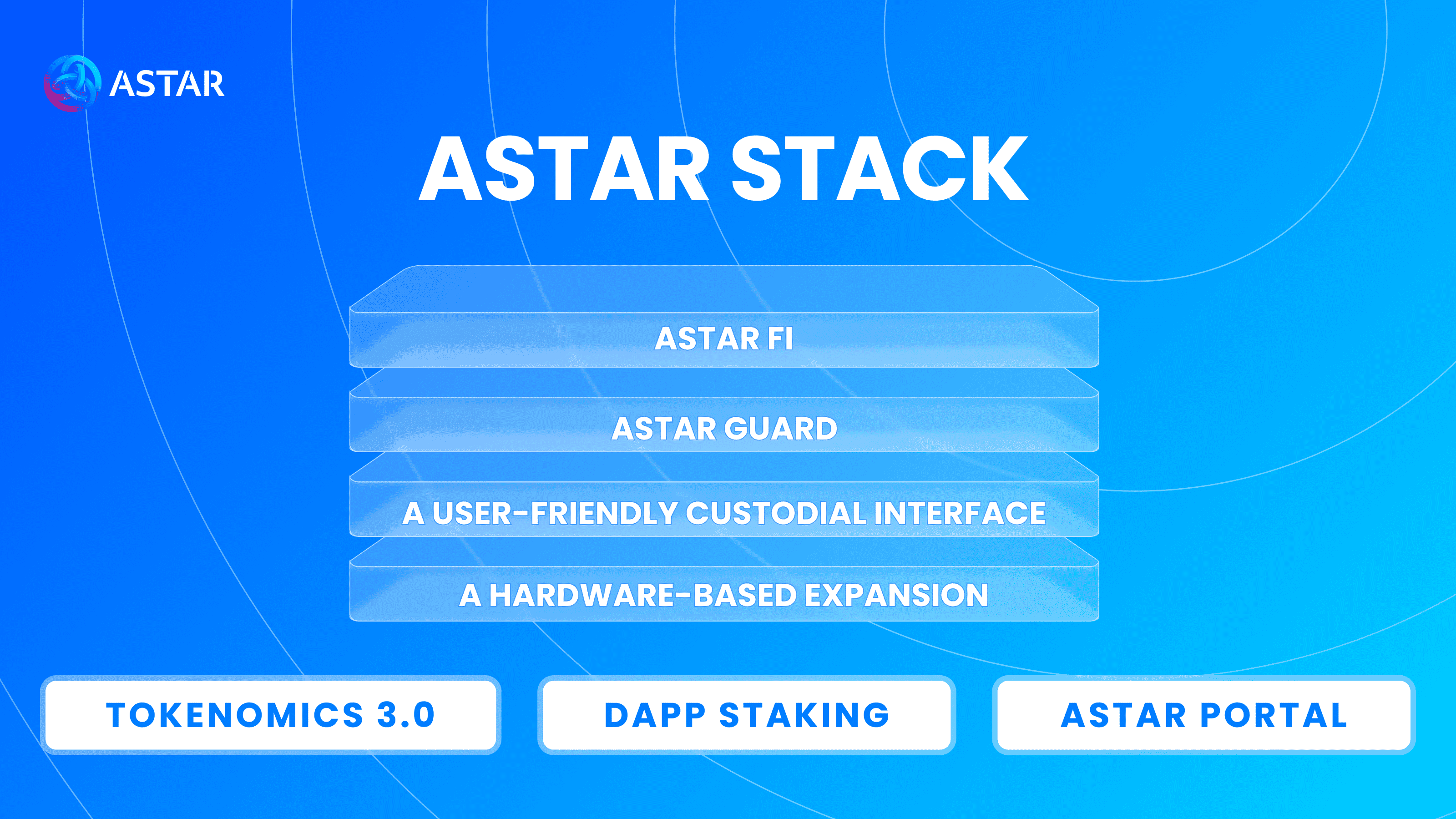

In early 2026, the Astar Foundation will focus on strengthening core foundations that enable product execution in later phases:

- Tokenomics 3.0, designed to support token health

- A revised dApp Staking model focused on rewarding meaningful contribution while limiting emissions

- A rebuilt Astar Portal as the central interface for ecosystem participation

These foundations establish the base required for product delivery, with clear scope, timelines, and execution discipline.

The objective is clear:

Build high-quality products that generate real economic activity and route value back to ASTR through mechanisms such as protocol fees, buy-backs, and supply reduction.

Note: A separate post will follow, focused specifically on token value creation and accrual mechanisms, and how product execution connects to sustained ASTR relevance.

Introducing Astar Stack

Astar Stack is Astar’s product execution stack for driving sustained onchain financial activity. It translates Astar’s infrastructure into user-facing products that enable participation in DeFi and onchain finance through simple, secure, self-custodial experiences, without requiring users to understand blockchain mechanics.

Under Astar Foundation oversight and with Astar Collective approval, Astar Stack combines applications and devices into a coherent product system. Each component has a defined role in reducing friction, improving safety, and supporting repeat usage, while remaining modular and independently evolvable.

Astar Stack comprises four components. Astar Fi serves as the primary onchain personal finance interface, enabling access to curated DeFi opportunities and simplified management of onchain financial positions. Astar Guard provides a dedicated safety and risk layer, delivering monitoring and alerts that improve confidence in onchain activity. Over time, a user-friendly custodial interface and hardware-based expansion will be explored to act as the secure entry point for onboarding, custody, and daily interaction with Astar Stack products, further reducing friction and embedding security and usability at the system level.

In its current phase, Astar Stack focuses on two products.

Astar Fi

Astar Fi is positioned as a self-custodial web3 personal finance hub for retail users entering onchain finance.

Astar Fi focuses on:

- Access curated DeFi opportunities

- Participate in yield-generating onchain activity

- Manage onchain financial positions through a simplified interface

Astar Fi is developed under Astar stewardship, with economic activity structured to reinforce ASTR through aligned mechanisms such as protocol fee capture, ecosystem incentives, and long-term usage anchoring.

Astar Guard

Astar Guard is a risk monitoring and safety layer designed to improve confidence and resilience in onchain financial activity.

It monitors key risk events such as:

- Liquidation exposure

- Protocol-level incidents

- Stablecoin instability

While Astar Guard is designed to serve the broader web3 ecosystem, ASTR plays a direct role in its value model. Advanced or professional-grade features can be accessed through ASTR-based tiers, creating direct utility for the token as usage scales.

By improving risk visibility and reducing loss events, Astar Guard supports sustained usage across Astar Stack.

Together, these components define Astar Stack as a product stack. The focus is execution: shipping products users actively use and anchoring activity through real onchain usage.

Parallel Execution: Burndrop

Alongside Astar Stack, Burndrop remains a core strategic objective under Astar Evolution Phase 2.

Burndrop continues to be developed in collaboration with Startale Group. While execution timing depends on external regulatory and partner conditions, the recent Burndrop PoC confirmed technical readiness, with ongoing refinements focused on usability and clarity.

The Foundation-led product roadmap provides a fully controlled delivery path while Burndrop progresses in parallel.

2026 Execution Roadmap

Q1 2026

- Launch of new ASTR tokenomics and revised dApp Staking

- Rebuild of Astar Portal as the central ecosystem hub

- Development of Astar Fi

- Launch of CometSwap, an ASTR-anchored DEX

Q2 2026

- Initial rollout of Astar Fi

- Launch of Foundation-curated DeFi infrastructure around USDSC

- Operational readiness for production deployments

- First Astar Fi integrations with curated yield strategies

Q3 2026

- Early rollout of Astar Guard

- Expansion of Astar Fi features, assets, and user flows

- Extension of curated DeFi activity to Startale’s JPY-denominated stablecoin

- Exploration of additional Astar Stack components

Q4 2026

- Consolidation of Astar Stack into a unified product experience

- Increased routing of product and DeFi revenue back into ASTR

Note: This roadmap represents the proposed execution direction and remains subject to Astar Collective alignment and external factors.

This establishes the execution baseline for 2026, with Astar Stack advancing on defined timelines and Burndrop progressing in parallel.