Table of Contents

- How Astar’s Tokenomics Works: A Dynamic Approach to Inflation

- The Challenges This Update Aims to Solve

- Latest Governance Update: Strengthening Astar’s Economic Model

- Solutions and Key Changes in the Update

- Overview: Current Emissions and Allocation (Pre and Post Update)

- What This Means for Astar’s Ecosystem

- Conclusion: Astar’s Commitment to Long-Term Sustainability

Astar’s vision has always been about building a network that lasts — one where incentives support both early adopters and long-term builders, and where the token economy evolves with the community, not ahead of it.

Today, that vision is measurable: Astar now runs at a sustainable ~4.32% inflation rate, dynamically adjusting rewards to reflect real network usage — not arbitrary emissions.

Back in 2023, we took a major step in that direction by launching Dynamic Tokenomics — a shift away from the traditional “fixed inflation” model to something far more adaptable. Instead of emitting a static amount of ASTR every block, Astar’s issuance is now shaped by real-time activity on the network — including how much ASTR is staked and how engaged the ecosystem is overall.

This wasn’t just a technical upgrade. It was a philosophical one. Astar now balances growth, security, and sustainability by letting the network’s behavior directly influence how rewards are distributed.

And we're not done yet.

With a new governance-approved update now live, Astar’s tokenomics has been further fine-tuned to better align staking rewards with real network activity, stabilize APRs, and reduce unnecessary emissions — all while ensuring the system remains sustainable for the long haul. These changes were made through adjustments to dApp staking parameters, which influence the base APR.

Importantly, they do not affect bonus rewards or allocations to collators, the treasury, or developers.

In this article, we’ll walk you through how Astar’s tokenomics works today, break down how inflation is dynamically managed, and explain what the latest changes mean for users, developers, and the broader ecosystem.

How Astar’s Tokenomics Works: A Dynamic Approach to Inflation

The Evolution from Fixed Emission to Adaptive Tokenomics

Before 2023, Astar followed a traditional fixed issuance model, where a predetermined amount of ASTR was minted per block. This ensured predictable rewards but did not account for network participation levels.

To create a more efficient and responsive economic system, Astar introduced Dynamic Tokenomics, which adjusts token emissions based on staking participation. This means that rather than issuing a fixed amount of tokens every block, the system automatically adjusts emissions to align with network engagement.

How Inflation is Calculated in Astar’s Dynamic Tokenomics

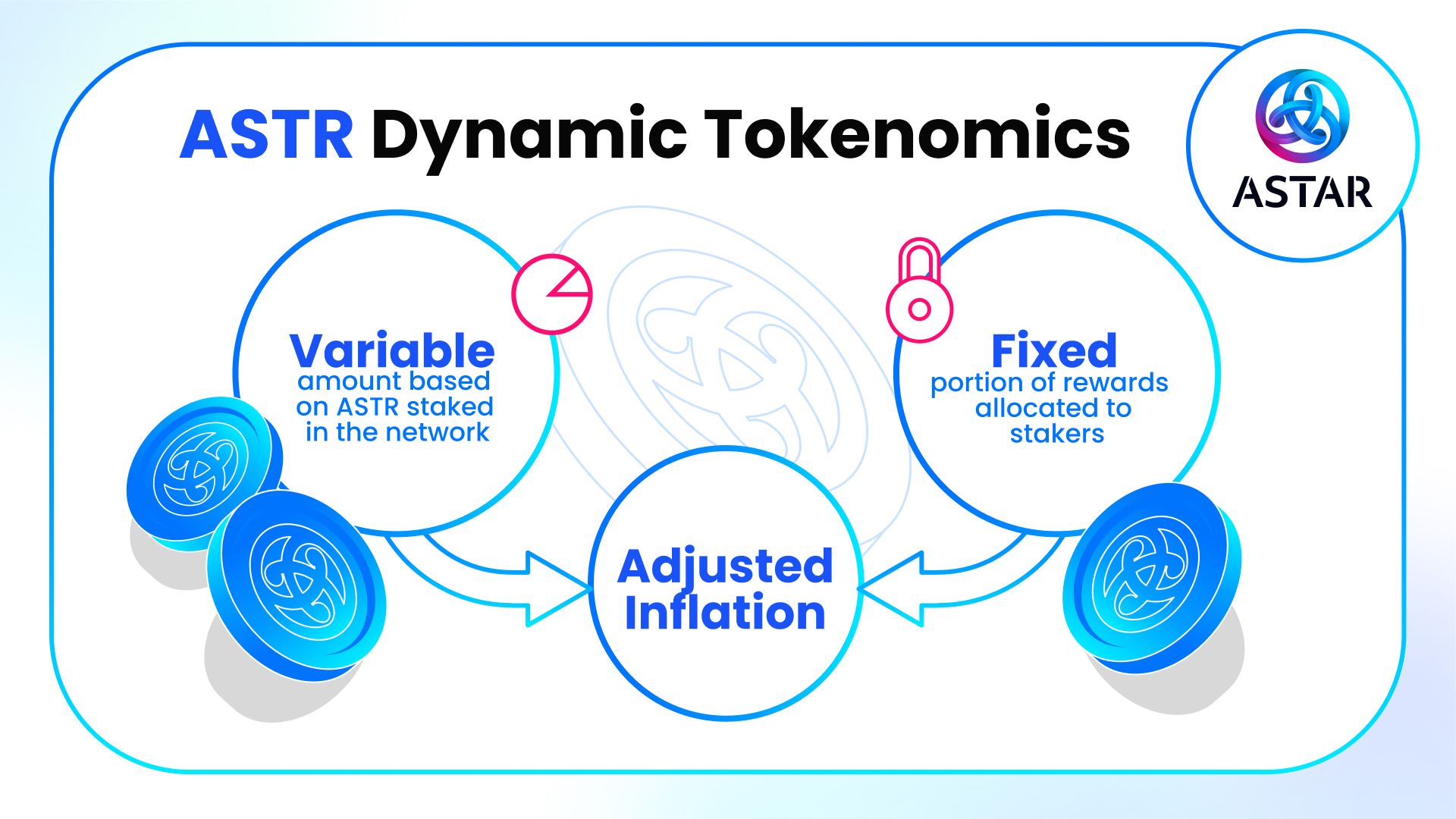

Astar’s inflation model isn’t based on a static percentage. Instead, it adjusts dynamically using two core components:

- BaseStakersPart: A fixed portion of rewards allocated to stakers.

- AdjustableStakersPart: A variable portion that fluctuates depending on how much ASTR is staked within the network.

This ensures that token issuance remains sustainable, responsive, and aligned with network participation. Additionally, two key factors help control inflation:

- Transaction Fee Burning: A portion of transaction fees is burned, naturally offsetting emissions and reducing the overall inflationary impact.

- Network Utilization: As more users engage in staking and dApp staking, token emissions adjust dynamically to match demand, preventing unnecessary inflation and dilution.

By implementing these mechanisms, Astar has built a system where token issuance is adaptive and continuously optimized for long-term sustainability.

The Challenges This Update Aims to Solve

While the Dynamic Tokenomics framework is a major improvement over static inflation models, certain challenges became more visible over time:

-

High and fluctuating staking APRs

With BaseStakersPart previously set at 25%, staking APRs often surged above sustainable levels, especially during periods of low staking TVL. This volatility made it difficult to manage inflation and created unrealistic expectations for stakers. -

Rising overall inflation

Annual inflation rates were trending higher than desired, contributing to an oversupply of ASTR in circulation — a long-term sustainability risk. -

dApp Staking APR instability

Since emissions were split between the fixed and adjustable staking reward components, staking APRs for users often fluctuated based on network TVL and participation. This made it harder for ASTR holders to rely on stable returns from dApp Staking.

The latest update directly addresses these pain points by adjusting how emissions are split — reducing staking emissions while preserving builder and collator allocations.

Latest Governance Update: Strengthening Astar’s Economic Model

To further refine Astar’s tokenomics, a recent governance proposal was approved and implemented. This update introduces key improvements to optimize token distribution and enhance sustainability.

Solutions and Key Changes in the Update

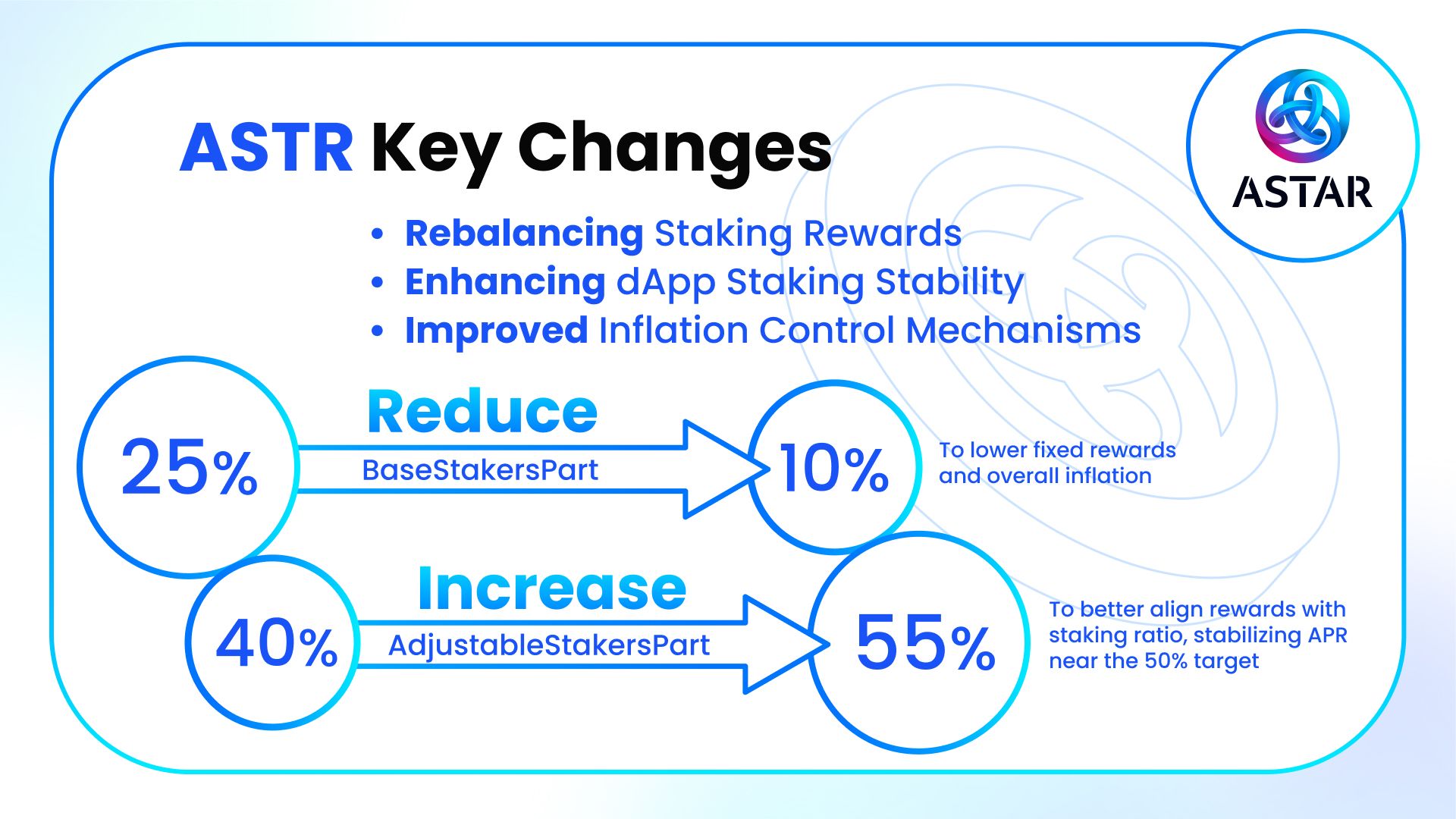

Rebalancing Staking Rewards

- The portion of ASTR allocated as a base reward to stakers has been reduced from 25% to 10%.

- This adjustment helps promote a more stable APR as the network moves closer to its ideal staking ratio of 50%, ensuring rewards remain meaningful without causing excessive inflation.

- This change lowers automatic token issuance, reducing overall inflationary pressure while maintaining strong incentives for users to stake their ASTR.

Enhancing dApp Staking Stability

- A larger share of emissions is now routed through AdjustableStakersPart — the parameter that governs emissions to TVL-based rewards like dApp staking — increasing it from 40% to 55%.

- This allows the dApp staking APR to become more predictable over time, especially as staker participation grows.

- It’s important to note that this update does not affect developer or builder earnings from dApp staking. Build2Earn parameters and rewards remain unchanged.

Improved Inflation Control Mechanisms

- A new minimum threshold of 2.5% has been introduced to ensure emissions do not fall below a sustainable baseline.

- Combined with ongoing transaction fee burning, these changes create a more predictable and responsive economic environment that can adjust to real-time network dynamics.

Overview: Current Emissions and Allocation (Pre and Post Update)

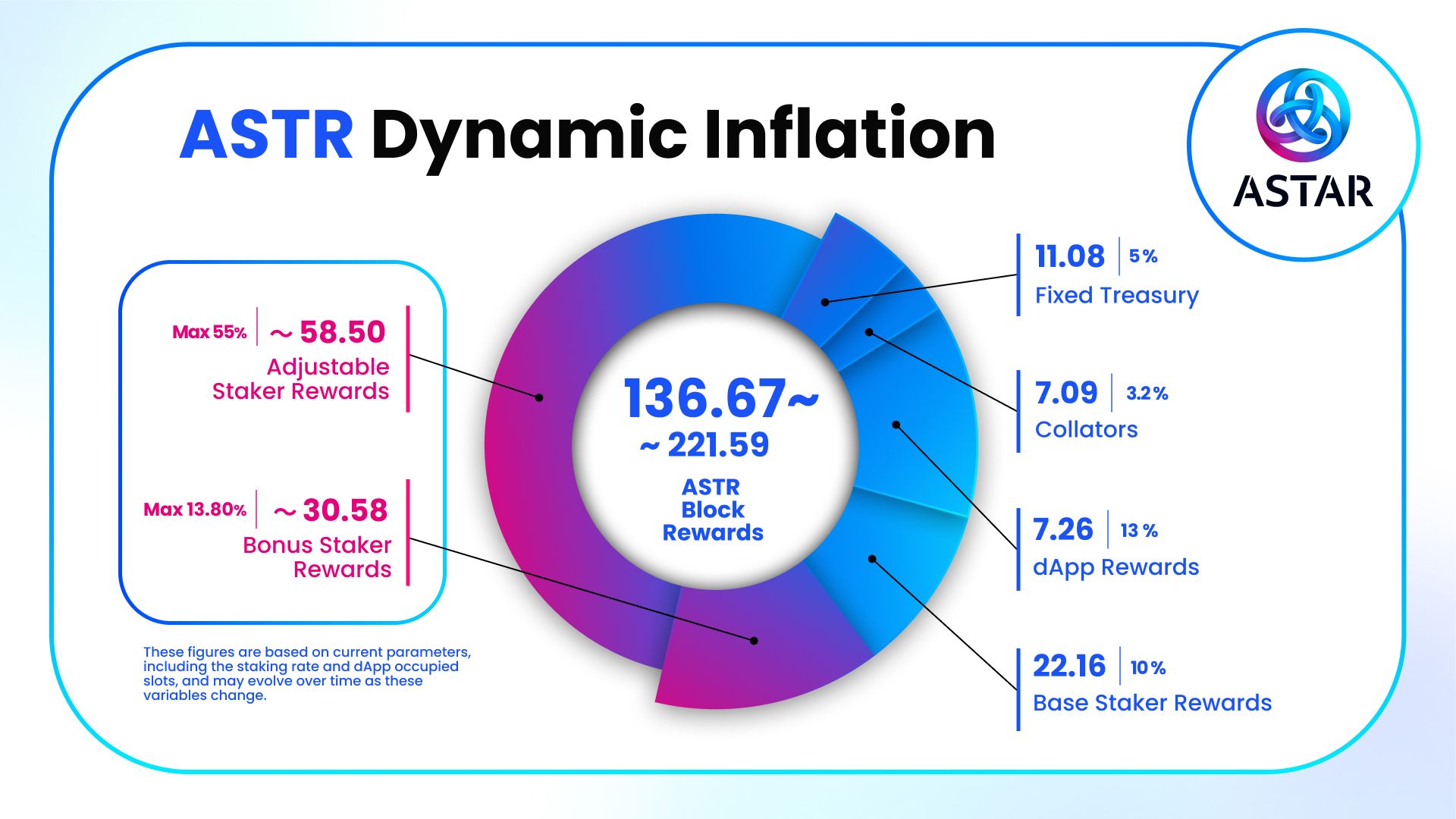

- Current annual inflation rate: 4.32% (Pre-Update: 4.86%)

- Total ASTR emitted per block: 136.67 (Pre-Update: 153.95)

- Total ASTR emitted per year: 360,139,867.16 (Pre-Update: 405,686,493.23)

- Allocated to Base Staker Rewards (before): 25% of emissions → 55.40 ASTR/block

- Allocated to Base Staker Rewards (after): 10% of emissions → 22.16 ASTR/block

- Allocated to AdjustableStakersPart (before): 40% → 42.55 ASTR/block

- Allocated to AdjustableStakersPart (after): 55% → 58.50 ASTR/block

The parameters allocating ASTR from block emissions to collators, treasury, and builder rewards (Build2Earn) remain unchanged.

Note: These figures are based on current parameters, including the staking rate and dApp occupied slots, and may evolve over time as these variables change.

What This Means for Astar’s Ecosystem

These updates represent a meaningful step toward realizing Astar’s long-term vision of a sustainable and responsive token economy. By aligning token issuance with real network activity, the updated model brings several key benefits:

Stabilized Rewards for Users

APR volatility has been a consistent challenge. This update helps stabilize staking returns by better aligning emissions with the network’s ideal staking ratio of 50%, offering more predictable rewards for participants.

Sustainable Token Issuance

Emissions are now more closely tied to actual participation. This ensures that ASTR enters circulation based on demand, helping to avoid oversupply and maintain a healthy token economy.

Reduced Inflationary Pressure

With the combination of lowered staking emissions and transaction fee burning, the overall inflation rate is expected to trend downward over time — supporting long-term value creation.

Conclusion: Astar’s Commitment to Long-Term Sustainability

Astar’s tokenomics has come a long way — from a fixed model to a dynamic, responsive system that reflects real-time network activity. This isn’t just a technical upgrade; it’s a reflection of how Astar is growing as a network and as a community.

The recent governance update marks another step forward. By refining how rewards are distributed and optimizing dApp staking, Astar is strengthening the foundation for long-term sustainability — without compromising on innovation or growth.

These changes aren’t about short-term gains. They’re about creating a future-proof economy where developers are empowered, users are rewarded meaningfully, and the ecosystem thrives together.

As Astar scales and more use cases come online, this dynamic and responsive tokenomics model will continue to be a core pillar — shaping a network that’s built to last.