Table of Contents

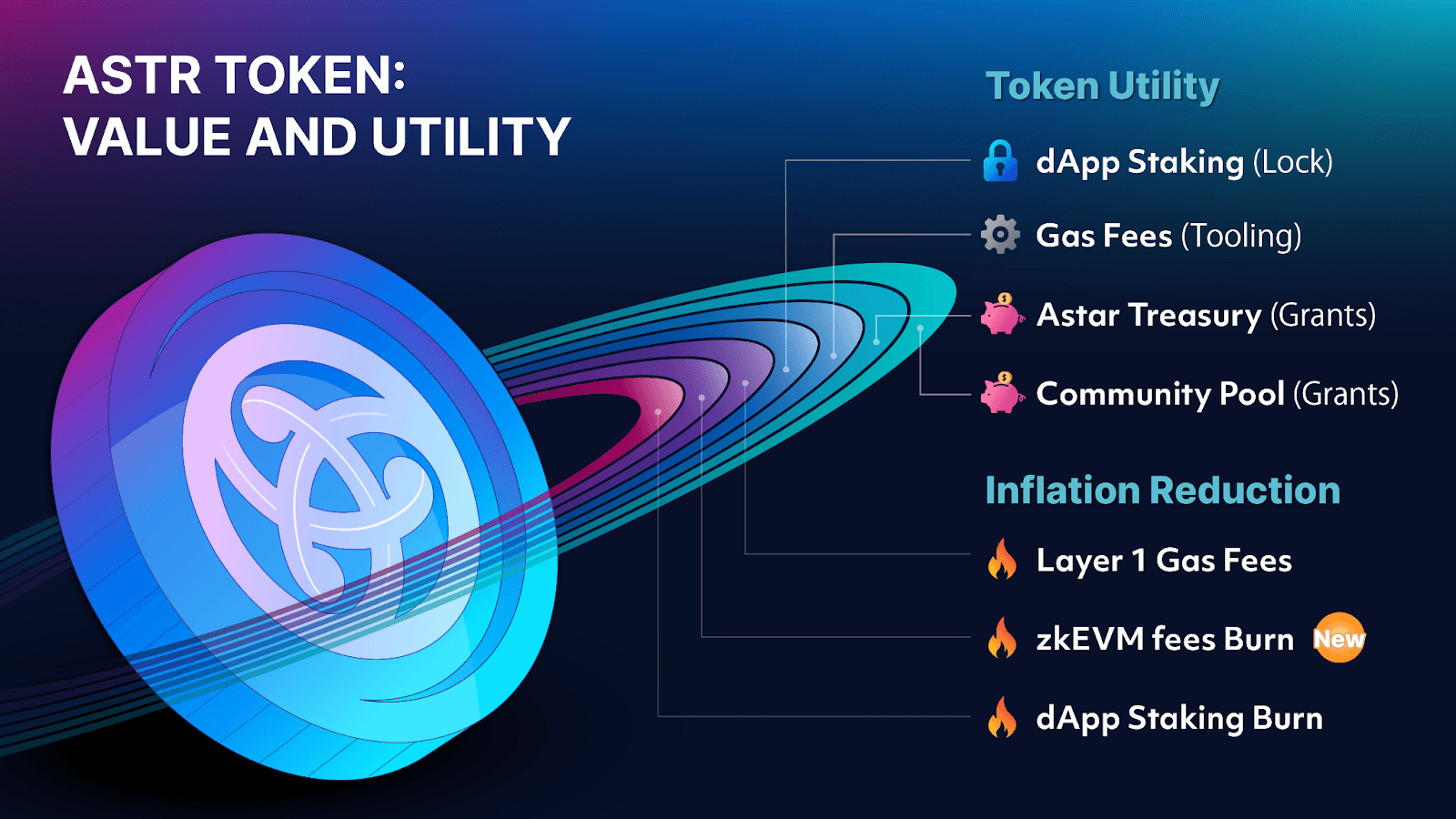

ASTR is the native token driving Astar Network, having ultimate utility by serving various functions such as staking rewards, gas, and grants. Additionally, network activity and burning mechanisms soften the overall rate of increase in ASTR.

DApp Staking for All Builders

Astar Network is particularly known for its innovative feature, dApp staking. This feature is a game-changer in the crowded blockchain space, where growth is all about network effects. Traditionally, there have been few financial incentives for early developers to deploy smart contracts. Astar Network has changed that by natively supporting developers to create dApps and infrastructure through the dApp staking grants program.

DApp staking is the program for developers to build dApps and receive developer incentives in return. By continually receiving developer incentives, teams can focus more on building and improving their dApps. With the addition of Astar zkEVM, dApp staking is now available to the Ethereum community.

One of the primary benefits of deploying Astar zkEVM is that it provides more choices to build upon using the Astar Tech Stack. With both Astar Substrate (Layer 1) on Polkadot and Astar zkEVM (Layer 2) on Ethereum, developers have more choice, and a greater variety of tools to create and build with.

With dApp staking available to both Substrate and Ethereum-based dApps, the program is able to attract builders from a larger pool of smart contract developers who can use the ASTR token to financially support their development activities.

Additionally, in the dApp staking V3 model, rewards that aren’t claimed by developers are burned, which soften the overall rate of increase in ASTR.

Astar zkEVM Buyback and Burn Mechanism

In general, Layer 2’s are valuable additions to Layer 1 blockchains. By offloading transactions from the main chain and processing them on Layer 2, Astar zkEVM makes more efficient use of blockspace resources on Ethereum, thereby enhancing its scalability. Similar to how other rollups work, Astar zkEVM processes transactions from users for a small fee. The sequencer then orders and batches these transactions before submitting them to Ethereum Layer 1, where anyone can verify the state. The validation of pending transactions occurs after the Aggregator and Prover components of the zkNode work together to mine a valid zero-knowledge proof - a compressed and highly efficient way of utilizing Layer 1 blockspace. In this way, users enjoy the security of Ethereum in an optimized way, while not worrying about expensive gas fees.

An integral part of the zkNode is the Sequencer, which earns revenue whenever users execute transactions on Layer 2. As long as the Sequencer revenue exceeds the cost of submitting batches of transactions to Ethereum, Layer 2’s are profitable. The Sequencer on Astar zkEVM pays the Aggregator for its services in ASTR, and all ASTR paid out is burned, a mechanism that softens the overall rate of increase in ASTR.

At first, Astar zkEVM will have one sequencer, and use ETH for gas. ETH earned through sequencer activity on Astar zkEVM will be used to buy back and burn ASTR through a trusted and independent 3rd party, a mechanism that softens the overall rate of increase in ASTR further.

How the entire ecosystem brings value to ASTR

The Astar Tech Stack is the aggregation of all the technology, tools, and infrastructure designed to simplify the creation of custom dApps and blockchain-based products for enterprises, on Astar Network. It includes everything from the underlying blockchain to custom pallets for specific use cases, and Astar applications for users and developers built on top.

More flexible options for Enterprise

Japanese enterprises and real-world use-cases are becoming foundational to the Astar ecosystem, and Astar zkEVM, in combination with Astar Substrate, offer the most composable tech stack to build on. Currently, Astar zkEVM is focusing on the Japanese market, in coordination with Polygon Labs. At the same time, the greater range of solutions that Astar Tech Stack offers fulfills the diverse requirements of both dApp developers and enterprises.

Enterprises building on Astar are able to tap into tooling, integrations, and interoperability between VMs, and enhanced network effect via unification of web3 platforms and users across ecosystems, further driving awareness, demand, and productive growth of Astar Network.

The move to add Astar zkEVM to the Tech Stack expands our network to the Ethereum community, the largest in the web3 space, opening up new opportunities. As the Astar ecosystem gradually expands, this could lead to increasing participation in dApp staking by the community to support builders.

Ultimate utility and inflation reduction

ASTR is the token at the heart of the network, playing a multifaceted role within the entire ecosystem. There are three main functions of the ASTR token:

- As the token for the dApp staking grants program. Builders that create projects or provide value to the network receive developer incentives.

- Tooling developed on Astar Network allows developers to use ASTR for gas fees.

- Both the Astar Treasury and Community Treasury are used to support network growth and fund projects within the community using ASTR tokens.

Network activity across the Astar Tech Stack reduces the rate of inflation of ASTR. Additionally, dApp staking V3 introduces a mechanism that burns unused rewards to further reduce the amount of ASTR in circulation. In total, three functions soften the overall rate of increase in ASTR:

- In the Astar Substrate environment, 80% of the ASTR used for gas fees are burned.

- In the Astar zkEVM environment, network activity reduces the amount of ASTR in circulation. Most importantly, ETH earned from Sequencers is used to buyback and burn ASTR (see above for details).

- In the new dApp staking model, unused rewards are burned.

ASTR is the native token of the network, having ultimate utility by serving various functions, such as staking rewards, gas, and grants. Network activity and dApp staking burn mechanisms soften the overall rate of increase in ASTR.

In Summary

ASTR is Astar Network’s native token, serving various functions including staking rewards, gas, and grants to provide essential utility for the ecosystem. Innovative features like dApp staking financially incentivize developers, while burning mechanisms counterbalance the ASTR supply increase. The ASTR token is integral for both developer incentives and network activity, with burned tokens and buyback mechanisms helping to moderate the increase in supply. Through these tokenomics, ASTR tokens’ utility is enhanced, further supporting the network’s growth and ability to attract developers and enterprises, particularly in the Japanese market.

* This figure is an example, only, and should not be quoted.