Table of Contents

As Astar enters 2026, the focus shifts toward execution and how economic activity across the ecosystem translates into value for ASTR.

This article outlines how Astar approaches value capture across four areas: tokenomics, products starting with Astar Stack, DeFi and Asset Management operations, and Burndrop.

Ownership, Execution, and Value Flow

Astar’s 2026 strategy focuses on product delivery. While collaboration across the ecosystem continues, operational control, and economic value will remain under the Astar Collective.

The objective is straightforward: build products and operate infrastructures that generate real economic activity, and ensure that value created onchain is captured and routed back to ASTR.

Tokenomics as the Base Layer

In early 2026, updated tokenomics and the revised dApp Staking model will shift focus to emissions discipline, simplified participation, and improved predictability. These changes move ASTR to a fixed maximum supply of approximately 10.5B ASTR prior to any Burndrop effects, and apply a decay factor to the inflation, supporting more stable supply dynamics as product and operational activity scales. Elements of the updated token issuance framework, including decay-based issuance behavior, were exercised on the Shibuya testnet.

Tokenomics will function as a structural layer that preserves ASTR token and reinforces value generated from new products.

ASTR: Value Creation Through Products

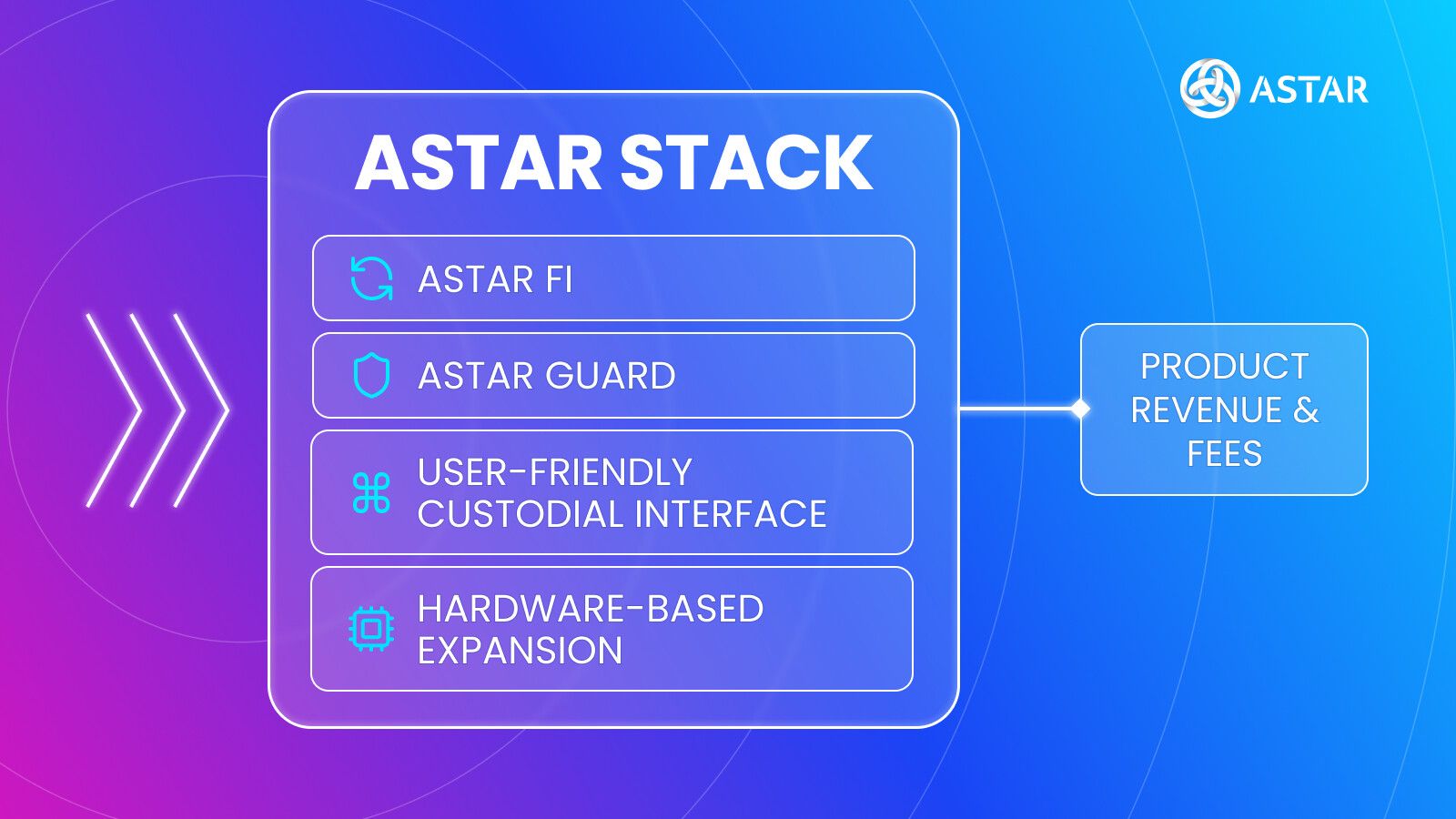

Astar Stack is an integrated product stack for generating onchain economic activity under Astar Collective, giving value back to ASTR holders.

Astar Fi acts as the core financial interface of the stack and the primary source of economic activity. It enables users to save, earn, spend, and manage onchain assets through a unified experience. Value is generated from curated DeFi participation, payments, and asset flows, producing recurring revenue tied to real financial usage rather than speculative activity. As usage grows, these activities produce consistent economic output tied to real financial activity.

Astar Guard provides a dedicated safety and risk monitoring layer that supports sustained participation in onchain finance. It generates revenue through premium access tiers and professional monitoring services. More importantly, it increases trust, reduces loss events, and improves retention across the stack, strengthening long term product led value capture.

Beyond these active products, Astar Stack is designed to expand over time. Additional access and distribution layers are intended to complete the overall product vision.

A mobile custodial interface and a hardware based expansion represent future directions to simplify entry, reduce onboarding friction, and embed security more deeply across the user journey. These layers support value capture through transaction flows, premium features, bundled services, and partner integrations, while reinforcing retention and concentrating activity within Astar controlled surfaces as adoption grows.

Separately, secondary ecosystem products such as Comet Swap, operating as an ASTR-anchored DEX, provide additional sources of product-related value.

Across Astar Stack, revenue is treated as a core execution output. As activity grows, value is captured in a controlled and repeatable manner and can be allocated to reinforce ASTR.

DeFi and Asset Management Operations Across the Astar Collective

Alongside product activity, Astar captures value through DeFi and yield operations conducted across the Astar Collective, involving both the Astar Foundation and the Astar Finance Committee (AFC).

These activities include managing treasury funds, deploying liquidity, carefully participating in DeFi protocols, and earning returns from blockchain infrastructure.

The AFC oversees governance, risk management, and strategy for DeFi and yield activities that use the DAO’s onchain treasury. In parallel, the Astar Foundation manages and executes yield strategies for the Foundation treasury, including curator roles where appropriate. Together, they ensure that capital is deployed responsibly, transparently, and aligned with ASTR objectives.

Stablecoin infrastructure illustrates this approach. The introduction of USDSC and Startale’s JPY-denominated stablecoin creates demand for lending and liquidity markets. By curating and managing these markets, the Collective can earn curator fees, performance-based revenue, and protocol incentives that bring value back to ASTR.

This operational layer extends value capture beyond first-party products and anchors ASTR to underlying financial activity across the ecosystem through repeatable, risk-managed participation.

Burndrop and ASTR Supply Reduction

Burndrop operates as a supply-side mechanism within Astar’s tokenomics strategy, focused on reducing circulating ASTR through token burns.

As economic activity is generated across products and onchain operations, Burndrop provides a governance-controlled path to convert a portion of that value into permanent supply reduction.

This links ecosystem usage directly to ASTR burns, reinforcing token value without introducing inflationary pressure or affecting near-term execution.

Value Control and Allocation

Value captured across products, DeFi operations, and infrastructure is managed as shared economic capital at the Collective level. This includes product revenue, infrastructure fees, DeFi curation income, and treasury operations.

Allocation decisions are governed through established Collective processes and may be applied across several mechanisms depending on execution priorities and market conditions. These include reinvestment into product development and infrastructure, strengthening treasury resilience, governance-directed buybacks, or other supply-related actions that reinforce long-term ASTR value.

By keeping allocation flexible and governance-led, the Collective avoids reliance on fixed mechanisms that may lose effectiveness over time. This approach allows Astar to respond to changing market conditions, execution needs, and growth opportunities while ensuring that captured value continues to reinforce ASTR over time.

Closing

In 2026, Astar’s priority is clear: ensure that economic activity across products and onchain operations compounds into durable value for ASTR under Collective control.